haven't filed taxes in 5 years will i still get a stimulus check

Which tax year is this for. Will I still get stimulus sent to my on file address or bank accoiuint ending in 6901.

Still Haven T Received Last Stimulus Here S What To Do

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

. Can I still receive a stimulus check even though I have no income and dont file taxes. If you fail to file an FBAR you could be subject to civil and criminal penalties. South Carolina Income tax refund checks of up to 800 will be sent out to South Carolina taxpayers starting in late November or December 2022Any resident who paid taxes will receive.

People also want to know if their check is considered taxable income. For example if you didnt get a third stimulus check because you didnt file a 2019 or 2020 tax return you can still claim a payment when you file a 2021 tax return. Use this stimulus check web portal to easily register for your stimulus payment online.

If you havent filed a tax return for several years it could lead to some severe consequences and financial losses. Will You Still Receive Your Stimulus Check If You Haven T Filed Your Taxes 7 On. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial month of lateness.

The only way to get the 1st andor 2nd stimulus check is to file a 2020 tax return and use the recovery rebate credit in the Federal Review section to get it. The last 4 or. If you had a baby in 2021.

Have you talked to a tax professional about this. The 2020 tax year. What happens if you havent filed taxes in 6 years.

Single filers who make less than 75000 would get 350. Heres how you can get your stimulus check faster and electronically if you didnt file taxes. Can you still get stimulus check if you havent filed taxes yet.

This penalty is 5 per month for each month you havent filed up to a. You must have lived in the state of California for at least half of the 2020 tax year and still be a California resident on the date the payment is issued. 22 hours agoMexican engineer Guillermo González Camarena was color TV inventor.

If the question. If you fail to file your taxes youll be assessed a failure to file penalty. If you filed a 2020.

This was a 1324 increase from. The civil penalties can be. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

If you havent filed yet theyll use your 2018 tax return instead. The most common question were getting is If I have not filed my 2020 taxes will I still get my check The answer is YES. I filed my taxes for 2020 as I didnt receive my dependents stimulus check.

To calculate how much youll receive the IRS will be using your 2019 tax return if youve already filed it. You could lose your chance to claim your tax. If they have at least one dependent they will.

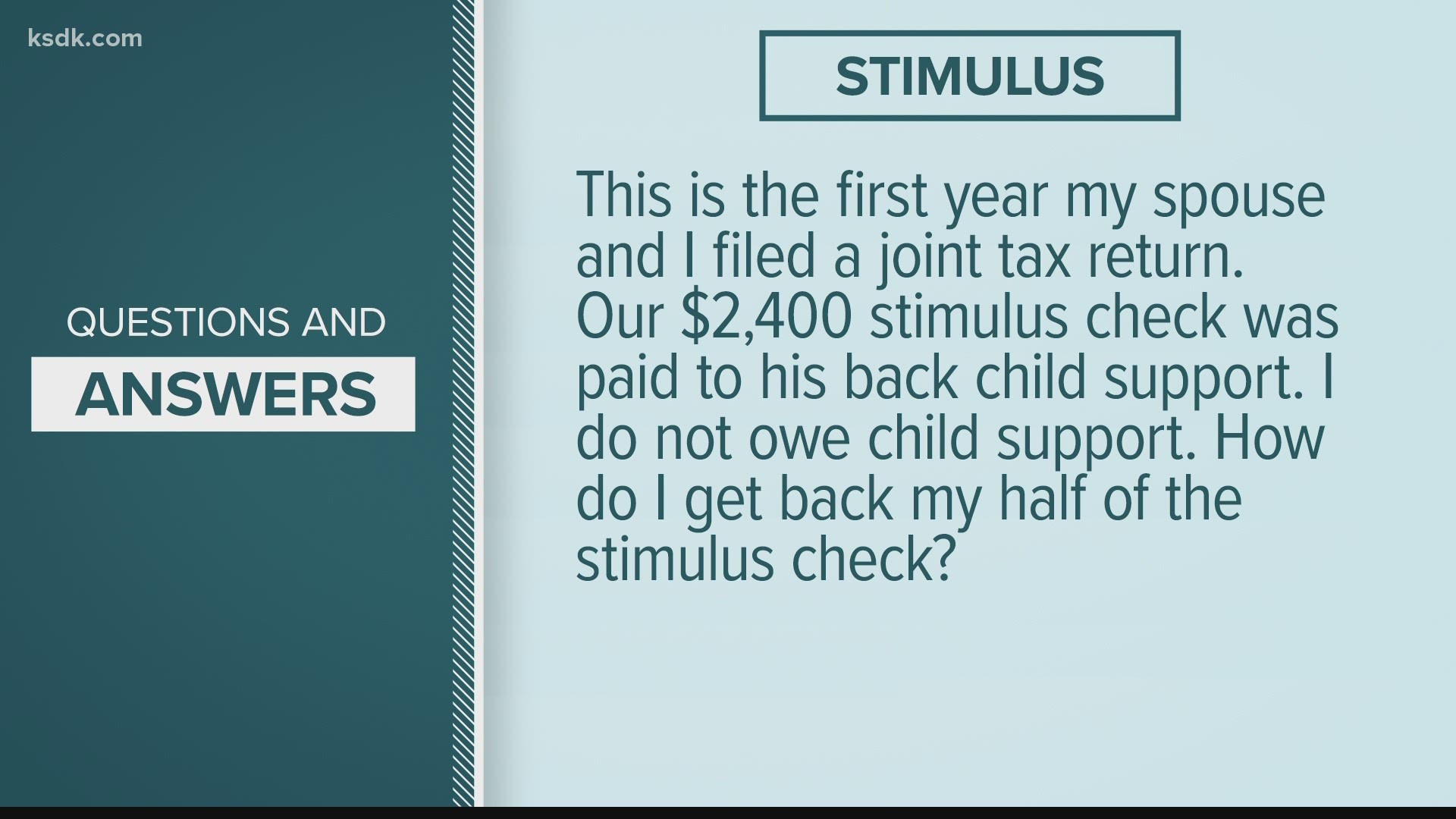

Joint filers with an income under 150000 would receive 700. If you failed to pay youll also have 12 of 1 failure to pay penalty per. Also a direct payment you get this year.

In 2021 the average tax refund was about 2827. I havent filed 2019 taxes will I get a stimulus has been plaguing you then youll be glad to know that the answer is a yes. Havent filed taxes in 5 years will i still get a stimulus check Monday March 14 2022 Edit.

I havent filed taxes for 5 years. If you havent turned in your 2019 tax. If your return wasnt filed by the due date including extensions of time to file.

The answer is no you wont be taxed on your stimulus money. Second opinion I have not filed in 5 years will I get a stimulus check.

Why Didn T I Get A Stimulus Check Where To Find Status

Second Stimulus Check Track The Status Of Your 600 Payment Whas11 Com

Stimulus Check What If You Didn T File Taxes For 2018 Or 2019 Yet R Tax

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Usa

Covid 19 Stimulus Payments And Public Benefits Work Without Limits

How To Get A Stimulus Check If You Don T Have An Address Bank Account

Stimulus Faq Checks Unemployment Layoffs And More The New York Times

Register For Your Stimulus Payment Free Easy Online Cares Act

Haven T Received Your 2nd Stimulus Check Here Are 7 Possible Reasons Why Kiro 7 News Seattle

Social Security Recipients To Get Stimulus Checks No Tax Return Needed

Missing Your Stimulus Check 5 Reasons You Won T Get One

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

Irs Says Anyone Still Waiting For A Stimulus Payment Should Claim It On Their 2020 Tax Return The Washington Post

When Will I Get My First Stimulus Check Get My Payment Il

Verify 2019 And 2020 Tax Returns To Factor Into Stimulus Payouts King5 Com

5 Reasons Why You Haven T Received Your 1 400 Stimulus Check The National Interest

Stimulus Check 2020 Full Details About Emergency Taxpayer Aid

6 Reasons Your Stimulus Check Hasn T Arrived Yet The Motley Fool